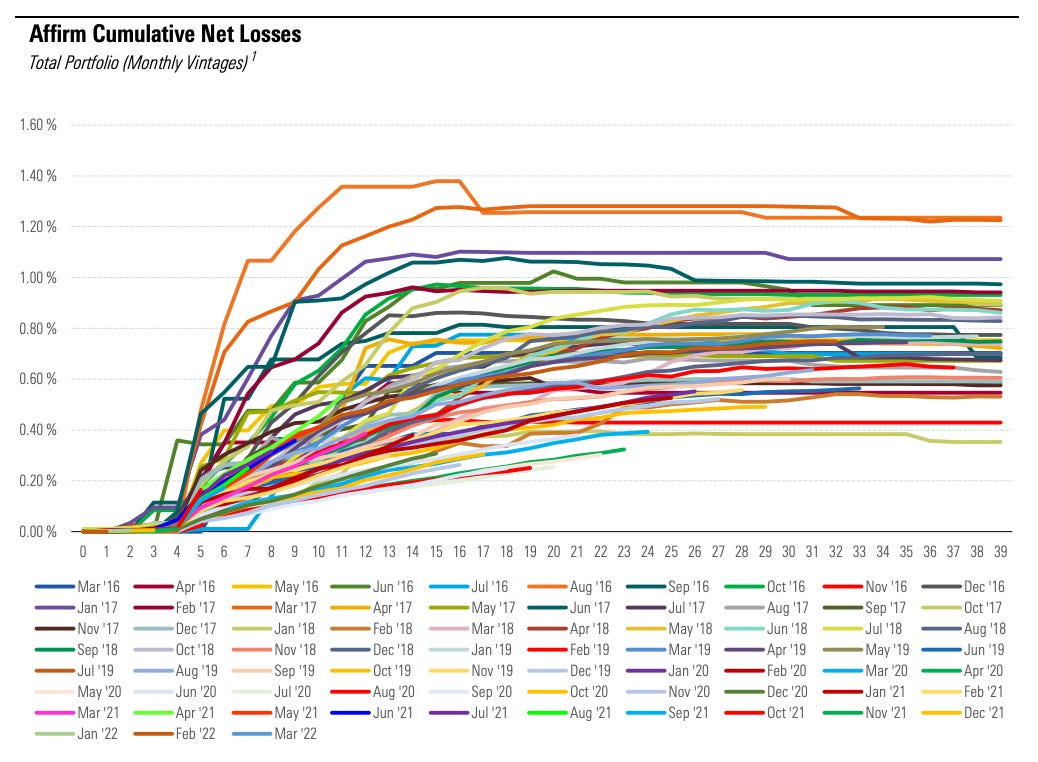

36+ mortgage credit pull window 14 days

Something to understand here is that any. Web They are 45 days 30 days and 14 days.

Pensacola Magazine June 2019 By Ballinger Publishing Issuu

Now they saying they will pull credit within 20 days and.

. The VantageScore model tells me 14 days to lump every. Web Mortgage Credit Pull window 14 vs 30. Web Mortgage Hard Pull Window - 14 days or 45.

Web That time frame ranges anywhere from 14 to 45 days depending on the FICO version and CRA used. This is because other creditors realize. Compare the Best House Loans for March 2023.

Web This window opens as soon as the first hard inquiry occurs and remains open for 14-45 days depending on the credit bureaus. Ad 5 Best House Loan Lenders Compared Reviewed. Web Within a 45-day window multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry.

Ad Dedicated to helping retirees maintain their financial well-being. Compare the Best House Loans for March 2023. To have the least impact on your credit score keep all your mortgage shopping options within the same window.

Web How Long Is the Mortgage Credit Check Window. Your credit score and other details can influence the approval process as well as the interest rate for. As I understand it The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home and that their searching may cause multiple lenders to request their credit report.

Comparisons Trusted by 55000000. For FICO Scores calculated from older versions of the scoring formula this shopping period is any 14 day span. Web Hard inquiries normally occur when a consumer formally applies for some form of credit like an auto loan a mortgage or a credit card.

Does anyone know what is the window for credit pull for getting a mortgage loan. Web 14 day window during a credit hard pull. The ones used by most.

Apply Get Pre-Approved Today. Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web The good news is that the majority of credit scoring models will lump multiple inquiries for one loan type together and treat them as a single inquiry if theyre made within a short.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web The mortgage credit pull window is a grace period where multiple mortgage applications are believed to only count against your credit score as a single. Im in the process of shopping mortgages and the first hard pull has hit.

Web If youre shopping for a mortgage you have a window of time where multiple credit inquiries by lenders are counted as a single inquiry for your credit scores. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Ad 5 Best House Loan Lenders Compared Reviewed.

These inquiries can remain on your credit. Apply Get Pre-Approved Today. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Newest versions are up to 45 days. To stay on the safe side keep your search. However some older FICO scoring models that are still in use have a 14-day window.

Web The latest FICO scores offer a 45-day window for rate shopping and VantageScore uses 14 days. Web If you apply for a mortgage you can expect the lender to make a credit inquiry. Web FICO gives you a 14-day grace period for mortgages when they go into one inquiry.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. For FICO Scores calculated from the newest. Comparisons Trusted by 55000000.

These time frames will count for inquiries not made in the last month but were still from a time when you were rate. In other words FICO treats similar loan-related inquiries within 14 days of. Web Hi All Had a general question so my mortgage lender oalreayd pulled my credit 2 times as a hard inquiry.

See if you qualify. I just did another application to lock in the rate. Web Depending on the type of credit score used by the lender this shopping window may range from 14 days to 45 days.

Pdf Investment Strategies That Beat The Market What Can We Squeeze From The Market

Utah Businesses For Sale Bizbuysell

Xba00lcnwn54hm

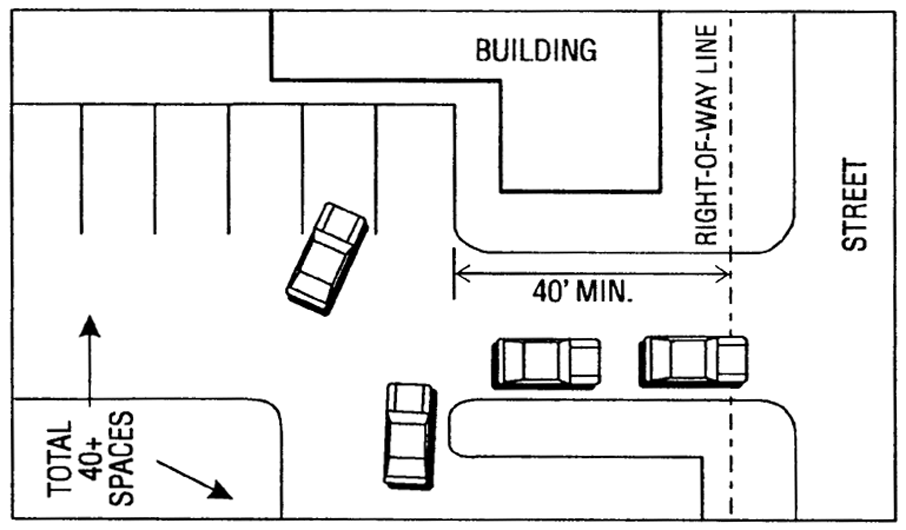

Chapter B Zoning Ordinance Unified Development Code Clemmons Nc Municode Library

1q1ppuyeyd4wkm

How Many Times Can You Pull Credit For A Mortgage

What Is The Mortgage Credit Check Window

The Mortgage Porter How Do Inquiries On My Credit Report Impact My Mortgage Approval

Real Estate Magazine November 2022 By The Peak Issuu

New Projects In Evershine City Vasai East Mumbai 54 Upcoming Projects In Evershine City Vasai East Mumbai

Inequalities And Environmental Changes In The Mekong Region By Agence Francaise De Developpement Issuu

Full List Of 116 Synchrony Store Credit Cards 2023

Resale Flats Near Embassy Tech Village Adarsh Palm Retreat Bellandur Bengaluru 36 Second Hand Flats For Sale Near Embassy Tech Village Adarsh Palm Retreat Bellandur Bengaluru

Calameo November 2022 Business Examiner Vancouver Island

How Many Times Can You Pull Your Credit For A Mortgage Supermoney

Credit Score For Mortgage What Is The Minimum Needed

How Many Times Can You Pull Credit For A Mortgage